| Jonathan Andreas |

Bluffton University |

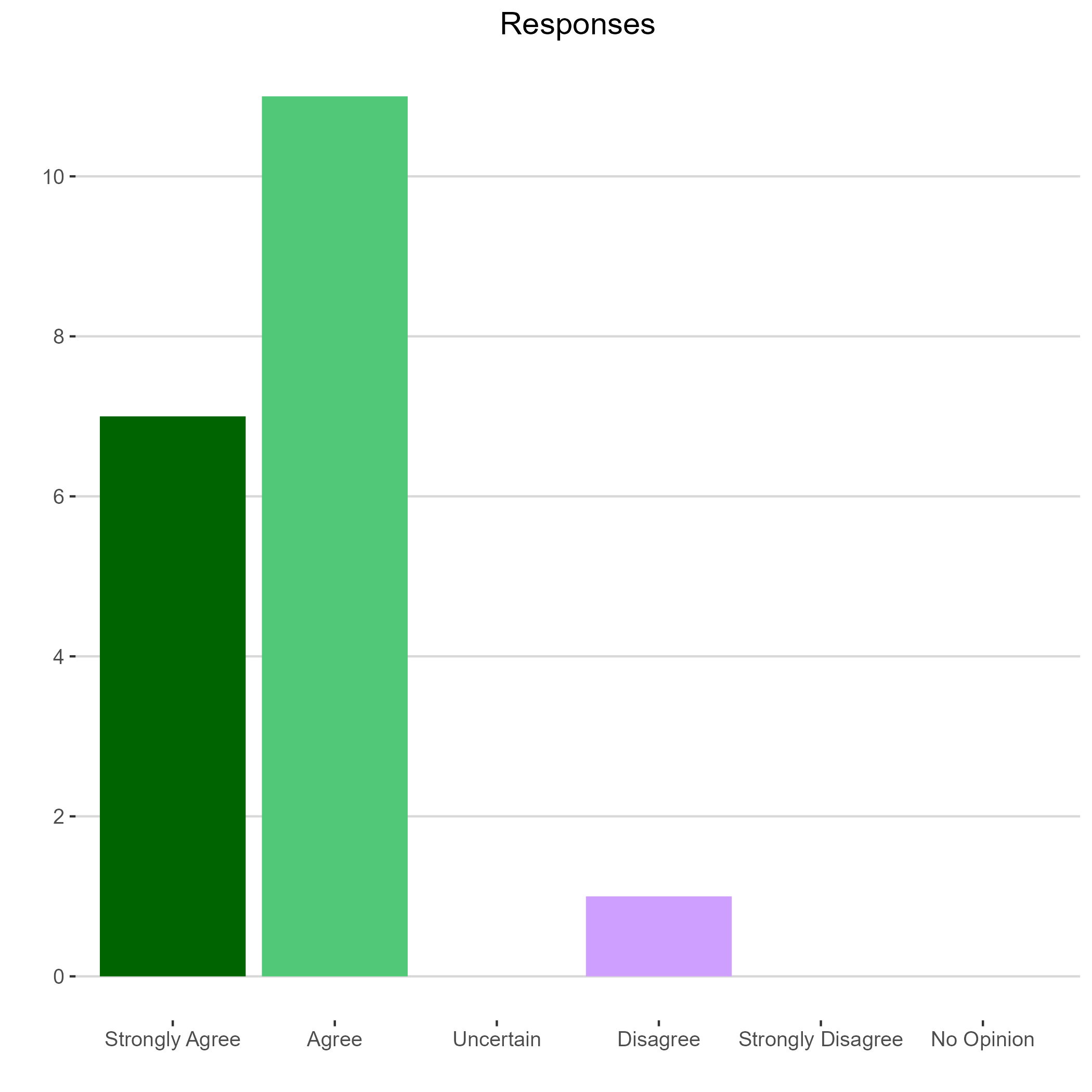

Uncertain |

9 |

It all depends on how they balance the budget after they eliminate the income tax. This proposal is like asking if it would be fun to buy a lot of stuff on credit card without considering how the debt will be repaid. |

| David Brasington |

University of Cincinnati |

Agree |

8 |

High-income people are sensitive to changes in income taxes, and it would help that Ohio would be the only state in the region without an income tax, but overall mobility would probably be positive but modest |

| Kevin Egan |

University of Toledo |

Strongly Agree |

10 |

We already see 50 states with widely different state funding mix of income/sales/property taxes. There is little evidence state funding is an important consideration for economic growth. What matters is the state is laser focused on its role of education, police, infrastructure and efficient laws that encourage growth. How the state is funded is way down the list of importance. How the state is funded is really about fairness. |

| Kenneth Fah |

Ohio Dominican University |

Uncertain |

8 |

|

| Will Georgic |

Ohio Wesleyan University |

Disagree |

7 |

Even for a household that is solidly in the top 10% of the income distribution, this works out to a savings of only about $8,000 per year. This clearly isn't trivial, but I don't think this is salient to a high income household considering moving to Ohio when they are also considering educational and economic opportunities and natural and consumer amenities. It also won't make low income individuals more likely to move to the state as roughly 40% of Ohioans already don't pay state income taxes. This may attract those in the top 1% or make professional athletes more likely to accept a contract from an Ohio based team, but that is about it. When you consider the spending cuts that will be necessary to support this and a likely decrease in the quality of public services, I think it is more likely that this would have a negative effect on immigration into the state. The best case scenario is that Ohio loses fewer residents migrating to neighboring states, but that is not the same as attracting more people to move to Ohio. |

| Bob Gitter |

Ohio Wesleyan University |

Disagree |

8 |

When our services decline, people will in all likelihood leave. |

| Paul Holmes |

Ashland University |

Disagree |

5 |

Few people really do this, and even fewer would select Ohio. And I don't see this being a big attractor for businesses. |

| Faria Huq |

Lake Erie College |

Agree |

5 |

|

| Michael Jones |

University of Cincinnati |

Agree |

5 |

|

| Bill LaFayette |

Regionomics |

Uncertain |

6 |

This will be the Tiebout hypothesis at the state level. There will be a sorting of residents. Those who prefer higher levels of public services will move out and those who prefer low taxes over strong public services will move in. |

| Trevon Logan |

Ohio State University |

Uncertain |

8 |

|

| Diane Monaco |

Economics Professor |

Disagree |

8 |

“State Income Tax Elimination & Economic Growth”

Democracies do a more favorable job than autocracies (Ohio’s current state structure) in implementing economic redistribution policies, economic growth & income inequality reductions. Individual income tax systems do affect long-term economic growth. Income tax rate cuts encourage people to work, save, and invest, but if the tax rate cuts are not financed by “immediate” spending cuts they will result in an increased federal budget deficit, which in the long run will decrease national saving & increase interest rates. Tax base increasing measures can also decrease the effect of tax rate cuts on budget deficits, and decrease the effect on labor supply, saving, and investment, thus decreasing the direct effect on economic growth. However, they also reallocate resources across sectors toward their highest-value economic use, resulting in increased efficiency & possibly increasing economic growth. The results suggest that not all tax changes will have the same impact on growth. Reforms that improve incentives, reducing subsidies, circumventing windfall gains, and deficit financing will be more favorable to economic growth, but very likely to create trade-offs between equity & efficiency. |

| Joe Nowakowski |

Muskingum University |

Uncertain |

6 |

|

| Curtis Reynolds |

Kent State University |

Strongly Disagree |

9 |

Not enough to matter, if at all. The likely higher sales taxes and lower spending on education and highways will not encourage people to move here. Businesses often already get tax breaks in their own state so there is not really a gain to moving to Ohio (and a large amounts of costs). Also, people (and business owners) care a lot about local amenities. I love living in Ohio, but not everyone likes the amenities here. Colorado has way more sun and mountains, Florida has sun and beaches, etc. Note, again, that there is no evidence that people or businesses moved to Kansas during their experiment, even thought it was claimed that they would. |

| Kay Strong |

Independent |

Strongly Disagree |

9 |

The quality of the workforce matters. Employers that would add real value will need skilled workers which Ohio is not able to provide due to is lack of focus on education. |

| Iryna Topolyan |

University of Cincinnati |

Disagree |

6 |

|

| Ejindu Ume |

Miami University |

Agree |

6 |

|

| Andy Welki |

John Carroll University |

Uncertain |

7 |

If services are cut as a result of the reduced tax revenue, it is unclear whether or not that is a net positive or a net negative. |

| Rachel Wilson |

Wittenberg University |

Disagree |

8 |

Taxes are one of many reasons people move to a state. Education, healthcare, weather etc. all matter. |