Last week, Massachusetts Governor Maura Healy released her budget proposal for the upcoming year and she has an unlikely commodity in the crosshairs with her new budget: candy.

Her new proposed budget includes a provision to remove the exemption for candy from the state sales tax, making it no longer a nontaxable item and subject to state sales tax.

While a tax on candy may seem like a frivolous matter, there is more at stake here than jobs for the state’s Oompa Loompas. CBS News reports removing the sales tax exemption for candy could raise $25 million for the state to spend on investments the governor wants to make in transportation and education.

The search for new sources of revenue is likely the origin of this policy change. Needling around the tax code and finding politically palatable ways to raise tens of millions of dollars of revenue is no easy task, so when a policymaker finds an opening, she often is willing to take it to raise revenues for programs she wants to fund.

That is why the governor says “this isn’t about a new tax.” This is “about” expanding the definition of what is funded under a tax that Massachusetts already has and a tax that is probably the broadest tax in the state: the state sales tax.

Despite the political motivation of the policy change, conventional wisdom among economists is that broader taxes are better for the economy. An exemption of something like candy from the state sales tax creates an incentive for people to purchase it relative to other goods that are subject to the state sales tax. If the state sales tax applies as widely as possible to many forms of purchases of goods and services, the incentives will be less distortionary and the economy will function most efficiently.

This is why many economists are wary of sales tax exemptions like exempting tampons from taxation–they narrow the tax base and create distortions in the economy.

But sales tax exemptions can have certain outcomes that policymakers may desire. One of them is offsetting the regressivity of sales taxes. Sales taxes fall more heavily on low-income households than on upper-income households since low-income households spend a larger percentage of their income on consumption. Carving essential goods like groceries, healthcare, and utilities out from sales taxes can help address this regressive aspect of a sales tax.

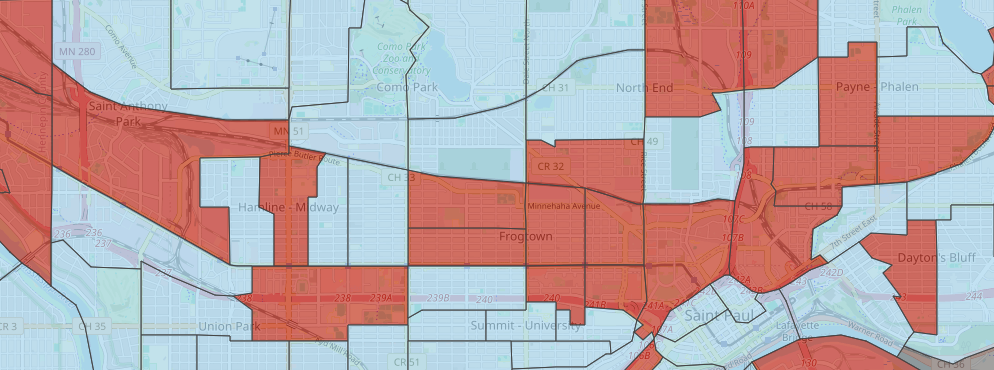

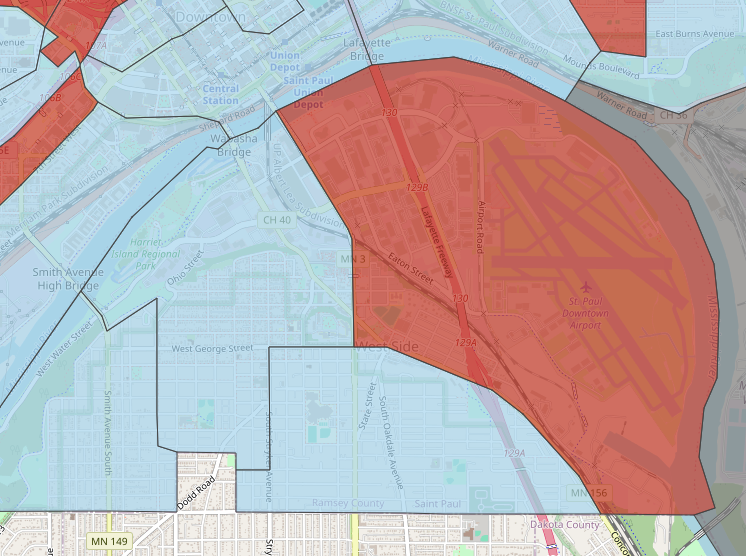

Candy falls under this category. A study by researchers at the University of Michigan and the University of Alabama-Birmingham found people living in lower-income neighborhoods and in areas without local food stores eat more snacks and sweets than those in higher-income areas. This means that subjecting these goods to taxation will likely mean the tax will fall more heavily on low-income households than on high-income households.

Those who are wary of specific exemptions to sales taxes argue that a better way to deal with the regressivity problems of a tax is to offset it with a rebate system. If you fund programs like an earned income tax credit with sales taxes, you can give cash to low-income people without giving an exemption to all families. This can be a more efficient way to handle the regressivity of a sales tax than exempting categories of goods from the tax altogether.

Another consideration with the taxation of candy is the public health impacts. Ten years ago, many local jurisdictions were making headlines for taxing soft drinks, citing their public health impacts. Making candy subject to sales taxes could be a way to reduce the public health impacts of candy.

Some researchers have found that dental guidelines around avoiding foods that stick to your teeth have little impact on consumers because consumers do not know which foods stick to their teeth and which do not. Candy consumption can also be a cause of weight gain, which can lead to a host of health conditions that can threaten lives. Candy and sugar consumption can also lead to cardiovascular disease and can even lead to nutrient deficiencies.

Correcting for these effects of candy consumptions could be seen as promoting economic efficiency if they lead to better health outcomes. If parents are feeding candy to children and that is leading to tooth decay, weight gain, cardiovascular disease, and nutrient deficiencies, then levying a tax on candy could help shift spending away from candies toward substitutes with less negative health impacts. Previous work on taxes on soda have shown these taxes lead to reductions in consumption.

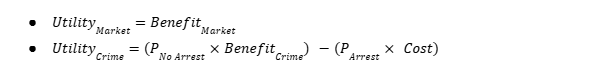

Another way removing the exemption for sales taxes for candy could promote economic efficiency is by curbing economic internalities, or irrationalities people have that lead them to make choices they would not make in sound mind. If candy consumption is linked to compulsive behavior, then taxing it could help bring people’s actual consumption of candy closer to their clearheaded goal consumption levels.

Similarly, a tax could help correct information problems. If information tools like nutrition labels are not effective at helping people understand the health impacts of candy, then a tax could be a more effective way at reducing consumption to levels that someone would consume at with better information.

Another consideration for policymakers weighing a candy tax is the administrative feasibility of such a tax. The definition of “candy” is slippery and a line will have to be drawn at some place to define certain foods as “candies” and other foods as “not candies.” Where this line is drawn will impact revenue, the efficiency of the policy, the effectiveness of the policy, the equity ramifications of the policy, and the public health impacts of the policy.

From the perspective of an analyst, I am curious to see what the impacts of this policy will be. Will this increase in taxes lead to precipitous decreases in candy consumption? Will there be detectable public health impacts? Will revenues raised exceed expectations? All of these are questions economists should be prepared to answer if this policy change goes into effect. Because this is where the rubber meets the road in public policy analysis: determining how changes like this impact real people’s lives.